Contents:

In December 2022, which marked the tenth https://forexarena.net/ of the LEI’s downtrend, seven of the 10 index components fell. The volume of manufacturers’ new orders for consumer goods and materials indicates businesses’ short-term operational spending. Average weekly hours worked by manufacturing workers indicates consumer income and business demand for labor to engage in ongoing production. A reading above 100 points signals economic expansion, while a level below 100 points indicates a slowdown. As a Premium user you get access to the detailed source references and background information about this statistic. We have built a platform to track the industry’s best Tactical Asset Allocation strategies in near real-time, and combine them into custom portfolios.

- The above chart displays the OECD’s Composite Leading Indicator for the United States from January 1, 1980 onward.

- Average consumer expectations for business conditions indicate forward-looking consumer sentiment for the next six to 12 months.

- The index posted steady declines throughout 2022, raising concerns that a recession could hit the economy in the early months of 2023.

- Additional interest rate hikes and a continuation of restrictive monetary policy could add downward pressure on the economy and exacerbate the challenges highlighted by the LEI.

- The Consumer Confidence Index is a survey that measures how optimistic or pessimistic consumers are regarding their expected financial situation.

For more details regarding the nuances of the index and how to interpret it, see this document. This https://trading-market.org/ Sector Assessment summarizes the key findings and recommendations of the 2007 Financial Sector Assessment Program update report for the Republic of Lithuania. The FSA, which focuses on developmental issues, should be read together with the Financial System Stability Assessment in order to get a full overview of the findings and recommendations of the 2007 Republic of Lithuania FSAP update.

Lead indicator signals further GDP slowing: OECD

Dc.description.abstractThe authors present a method for forecasting growth cycles in economic activity, measured as total industrial production. They construct a series which they aggregate into a composite leading indicator to predict the path of the economy in Lithuania. The cycle is the result of the economy’s deviations from its long-term trend. A contractionary phase means a decline in the growth rate of the economy, not necessarily an absolute decline in economic activity.

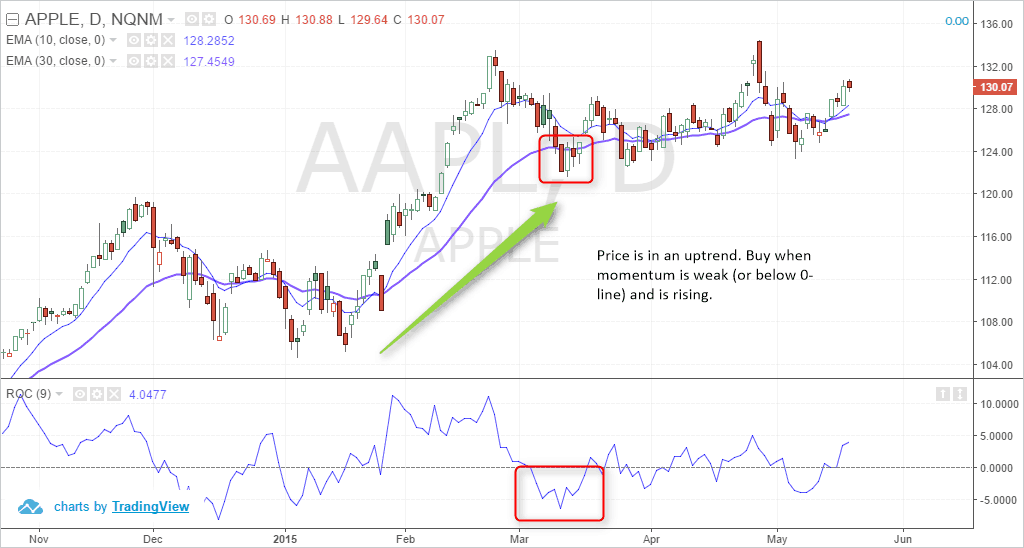

Having said that, we think this is a truer representation of the strategy’s performance. At the very least, it demonstrates that the results of our first backtest were likely too optimistic. Any timing benefit is mostly in the strength of the CLI data itself, rather than some attempt by the strategy to massage the data. On the 15th calendar day of each month , calculate a “Diffusion Index” based on CLI data at the previous month-end.

Statistics

Generally speaking, the strategy still successfully limited the worst market drawdowns and outperformed the market on a risk-adjusted basis. All strategies that trade based on economic data (GTT, RPV, etc.) are prone to revisions in that data. Economic data is often initially reported at one value and then later revised. That means that a backtest based on the data as it looks today may not accurately reflect positions that would have been taken in real-time. First, we’re going to replicate Grzegorz’s test, which includes a degree of lookahead bias.

- The cycle is the result of the economy’s deviations from its long-term trend.

- Any timing benefit is mostly in the strength of the CLI data itself, rather than some attempt by the strategy to massage the data.

- It includes key economic data points that are logically connected to the economic conditions that influence things like consumer spending and business investment.

- Although many approaches for tax simplification exist, a general trend in the region is to offer small businesses the option to be taxed based on their turnover instead of net income.

Although many approaches for tax simplification exist, a general trend in the region is to offer small businesses the option to be taxed based on their turnover … The study finds that many of the regimes in place are overly simplistic and neither take into … Stock prices are forward-looking in the sense that investors buy and sell stocks not based on what happened yesterday or what is happening today, but rather based on their expectations for the future. For example, a company may report impressive EPS and revenue numbers in a given quarter.

PBO expects Bank of Canada to hold rates for remainder of year

The paper analyzes the https://forexaggregator.com/ small business tax regimes in Eastern Europe and Central Asia and the impact of such regimes on small business tax compliance. Although many approaches for tax simplification exist, a general trend in the region is to offer small businesses the option to be taxed based on their turnover instead of net income. The study finds that many of the regimes in place are overly simplistic and neither take into account fairness considerations nor do they facilitate business growth and migration into the standard tax regime.

The signs that tell you a recession is coming – Investors Chronicle

The signs that tell you a recession is coming.

Posted: Fri, 03 Feb 2023 08:00:00 GMT [source]

Pizzati does not argue which peg is more appropriate, but he analyzes the implications of changing the exchange rate regime for different sectors … Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

The FSA, which focuses on developmental issues, should be read together with the Financial System Stability Assessment in order to get a … Department of Labor that counts people filing to receive unemployment insurance benefits. With the increases in unemployment that occur during an economic downturn, job security can be a serious concern.

The strategy would have produced equity-like returns over the last 60+ years, while significantly reducing drawdowns. It’s rare for a strategy that’s only based on economic data to be so successful at limiting losses. This is a test of the “Global Growth Cycle” strategy from Grzegorz Link that uses OECD Composite Leading Indicator data to time the market.

Composite leading indicator (CLI)

Due to the nature of CLI data revisions, the strategy is “peeking into the future” and using data it couldn’t have known at the time. We’re then going to estimate the impact of removing that lookahead bias. Is the online library of the Organisation for Economic Cooperation and Development featuring its books, papers, podcasts and statistics and is the knowledge base of OECD’s analysis and data.

According to data from The Conference Board, the LEI tends to peak approximately 11 to 12 months ahead of a recession. The index attracted headlines in January 2023 because its latest peak had occurred in February 2022, with consecutive monthly declines for the remainder of the year raising red flags about an impending recession. The spread between long and short interest rates indicates bond market participants’ expectations for future performance of the economy. Average number of initial applications for unemployment insurance indicates possible changes in unemployment, which reflects the level of business activity and affects consumer income. Amongst major emerging economies, stable growth momentum remains the outlook for the industrial sector in China, while in India, Brazil and Russia the CLIs point to growth gaining momentum. Despite the painful results of our data revision analysis, we don’t think that using CLI data in this way is without value.

Economic Bulletin Issue 1, 2023 – European Central Bank

Economic Bulletin Issue 1, 2023.

Posted: Thu, 16 Feb 2023 09:03:16 GMT [source]