Content

The IRS accepts digital copies of receipts, and apps and online services make it relatively easy to scan and save them. Bookkeeping is the process of recording daily transactions in a consistent way and is a key component of building long-term financial success. Putting it off means having to catch up at the end of the year—the more stressful and time consuming approach.

What are two types of financial records?

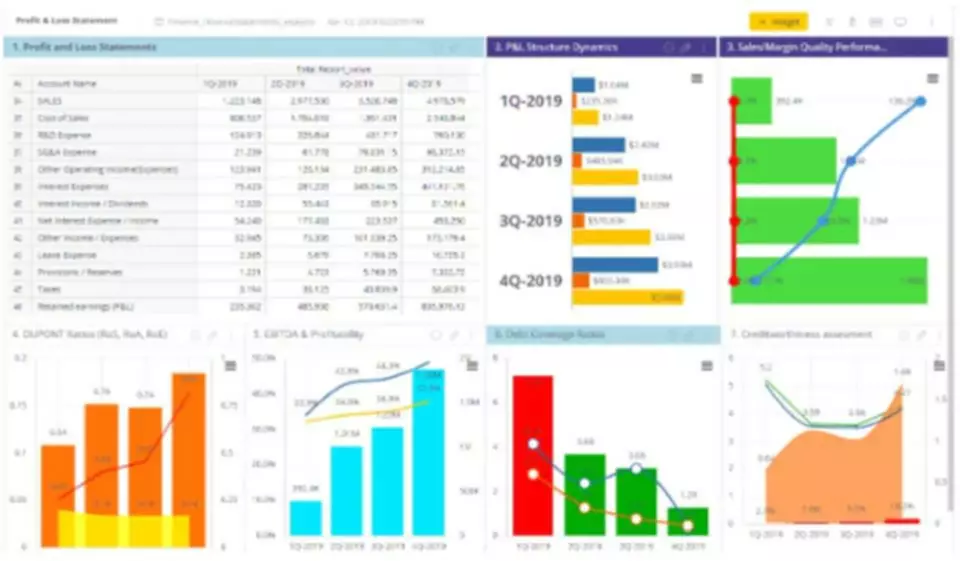

- Balance sheet: A snapshot of your business's financial condition at a single point in time, it shows what you own (your assets) vs what you owe (your liabilities).

- Profit and loss statement: Also called an income statement, this report shows your business's revenues and expenses.

If you mismanage this account, you could face severe consequences, including disbarment. We don’t recommend building your business off the back of your credit card. The interest rates are high, limits are often lower than other forms of credit, and they’re easily mismanaged. Your business operates as its own entity with its own credit rating. There are very specific rules regarding what you can and can’t do with them, and these rules vary depending on your jurisdiction. If you’re going to make an accounting error, it’ll likely be with your trust and IOLTA accounts. Businesses are complex, and you may need to set a budget for different categories like marketing, technology, etc.

Hire a CPA

Typical law firm bookkeeping tasks are preparing monthly income and balance sheet statements; preparing and completing tax returns; and forecasting future cash flow. Law firms need to ensure that their financial and accounting practices are up to par in order to grow their businesses. As an accountant or bookkeeper, it is important to be aware of the compliance regulations governing law firms in your jurisdiction. Familiarizing yourself with these regulations will help you effectively manage your law firm’s finances and avoid any potential penalties. The benefits of bookkeeping for a law firm include having accurate financial data, staying compliant with regulations, and being able to track finances.

Prosecutors say Murdaugh’s motive lurks in a history of theft. Can they tell the jury? – The State

Prosecutors say Murdaugh’s motive lurks in a history of theft. Can they tell the jury?.

Posted: Thu, 02 Feb 2023 08:00:00 GMT [source]

The importance of proper https://www.bookstime.com/ in maintaining the financial health of a law firm is equivalent to spelling success. Following the above best practices for law firm bookkeeping can help your firm stay organized and efficient and help you stay on top of all financial matters throughout the year.

Thinking About Exploring Your Options For Bookkeeping?

Nevertheless, many attorneys fail to separate revenue that covers incurred costs from their actual income. Failure to allocate appropriately can lead to inaccurate books, and battle compliance issues. Produce clean, detailed, and informative financial statements on a monthly basis, including the balance sheet, income statement, and statement of cash flows. Let our team of legal bookkeeping experts start doing the work for you. Practice Alchemy gives you a complete “plug and play” bookkeeping solution to manage your accounts and give you the necessary insights you need into your firm’s financials. Once you master the basics of accounting for lawyers, you can better navigate the everyday challenges unique to the legal industry.

See what strategic opportunities you have for reinvestment and plug those into your budget. If you’re trending behind, it is better to know sooner rather than later so you can react accordingly. – How much money are you collecting as a percentage of fees you are invoicing?

Tools

Your COA will look different depending on your jurisdiction, law firm’s size, and practice area, but will always have these categories. You’re responsible for recording the receipt and disbursement of these funds and posting the transactions to the ledger accounts of clients. To do this, legal accountants capture expenses, provide financial forecasting, and prepare financial statements. Without a trusted bookkeeper for attorneys, a legal accountant won’t have any data work off of.

- Outsourcing specific bookkeeping processes can help free up resources for lawyers and support staff so they can concentrate on more important matters.

- Your checking account is self-explanatory — its primary purpose is managing business revenue.

- Your budget is a vital tool for keeping you in control of expenditure and making sure you’re not overspending.

- Just as your clients rely on your expertise with the law, there comes a point when you need to call in accounting professionals.

Ultimately, it’s unwise to try and navigate your tax obligations alone. The last thing a new law firm needs is to get on the wrong side of the IRS. Consider consulting with an accounting firm to clarify your responsibilities and ensure you’re meeting them.