Contents

Sometimes known as an govt director or a principal, the senior VP slot is as excessive as most funding banking professionals get; some even spend their complete careers as vice presidents. Life as a senior VP could be very completely different from life as an analyst, affiliate or VP, largely because of the accountability shifts toward prospecting for new business. Investment banks receive a commission for all the successful transactions they make between agreeing parties.

- Commonly suggested, is the two-factor authentication method for verification of identity.

- MDs are directly responsible for company’s profitability, keep a track of markets, and how deals are happening.

- We have covered the various aspects of an investment banking cover letter for both the experienced and inexperienced applicant here in this article – Investment Banking Cover Letter tips and samples.

- Armed with the knowledge provided with a MBA degree, people with robust leadership intangibles and downside-fixing skills ought to excel in this position.

Finally, based on the complete analysis, the investment banking firm forms a structure of the public issue and launches it once it’s approved by the client. For the recruiting banker, the ideal candidate is somebody with high intelligence, love of money and the willingness to work all night, every night, with a big grin on his face, like the joker fromBatman. In a corporate finance position, you would assist the customer in raising funds to fund new initiatives or expand current operations. The team should have a solid understanding of applied finance and its ideas, since it entails calculating the correct balance between equity, debt, and securities to achieve higher levels of profitability. This is the most widespread profile in the investment banking domain and is usually considered as a foundation of investment banking. The majority of investment bankers around the world start with this profile.

If an entity decides to raise funds through an equity or debt offering, one or more investment banks will also underwrite the securities. This means the institution buys a certain number of shares – or bonds – at a predetermined price and re-sells them through an exchange. Financial engineering requirements sometimes determine the success of banking. A flexible model that evolves with the ever growing and changing technology, that is more adaptable is the need of the hour for Investment Banking Courses and business models. It is generally suggested that the banks spend considerable resources on strategy and optimization to avoid bad transactions and financial instability.

Why choose an Investment Banking career?

If money is a motivator for you, investment banking should definitely be on your list. An entry level analyst could expect to earn anywhere from $80,000 to $200,000 a year. This compensation is generally made up of base salary, performance-based hierarchy in investment banking year-end bonuses, and signing bonuses. If you work in an investment banking division , you usually will research corporations that could be concerned in a deal, you’ll build the financial models which worth the companies you’re looking at.

The downside to being an analyst in an investment banking division has at all times been the working hours. When individuals discuss 80 hour weeks in banking, it is investment banking analysts their referring to. Most banks have gotten insurance policies in place to chop analysts’ working hours, especially at weekends, however it’s still widespread to work from 9am to midnight – or later – on weekdays. Ex-Goldman banker turned educational Alexandra Michelsuggests it is because banking careerswere historically quick.

Between 2018 and 2023, the investment banking sector seems to be growing at a 1.2 percent CAGR. In this blog, we’ll look into the possible salaries an individual can make in the sector of Investment Banking. Managing Director– It takes a very long time and luck to become a managing director.

Investment Banking Business Model and Financial Stability

Securitized Products– These days, companies often pool financial assets – from mortgages to credit card receivables – and sell them off to investors as a fixed-income products. An investment bank will recommend opportunities to “securitize” income streams, assemble the assets and market them to institutional investors. P. Morgan and Goldman Sachs manage huge portfolios for pension funds, foundations and insurance companies through their asset management department. Their experts help select the right mix of stocks, debt instruments, real estate, trusts and other investment vehicles to achieve their clients’ unique goals.

Regarded by experts as one of the most work-life imbalanced jobs with high levels of stress, i-banking can prove to be a harsh career choice for many. It is a highly competitive field with enough finance veterans lining up with experiences and courses adorning their resumes. To make it in without experience and no MBA, it is important to shine ample light on what you can offer as a rookie in the investment banking firm. According to an article in Forbes, rising to the extent of vp for any one of many major banks within the nation is a extremely paid position ranging in pay of from around $124,000 to $165,000. MBA graduates with glorious leadership expertise and a want to maneuver up the job ladder can aspire to achieve this degree after the requisite job experience and job performance as decided by higher administration. If you want to get a financial institution job, begin by choosing a job that fits your degree of expertise.

You should be aiming for these 5 investment banks this year?

With the help of IPOs, huge companies like Facebook and Google have raised billion dollars capital. Therefore, this kind of financing helps the companies to share their profits with investors. It is a very senior position in investment banking that can only be attained after years of expertise. An MD is typically in charge of increasing business and converting potential clients into actual clients.

Investment banking is a division of the financial services industry that manages and expands the financial assets of its clients. Businesses can invest their assets with the help of investment bankers to boost the value of their portfolios. They typically act as brokers and counsellors, supporting clients in spotting and seizing profitable opportunities.

It is also for this reason that many top executives from companies, governments, and central banks have prior experience in investment banking. Research– Larger investment banks have large teams that gather information about companies and offer recommendations on whether to buy or sell their stock. They may use these reports internally but can also generate revenue by selling them to hedge funds and mutual fund managers.

And to get the job, you’ll have to first purchase the appropriate expertise and expertise, set up yourself in the banking business, and build knowledgeable community. Take your skills into account and resolve which place could be best for you.Teller. Bank tellers are the people who work at the front desk and handle transactions. They will need to have expertise in basic arithmetic and also customer support.

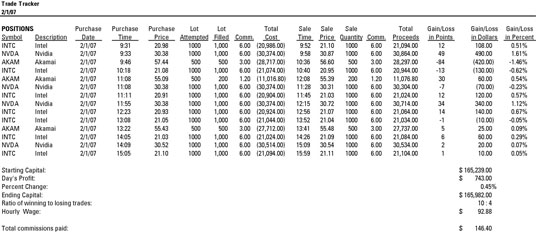

Global firms like Morgan Stanley, Goldman Sachs, JP Morgan Chase, Barclays, as well as well-known Indian banks like HDFC, ICICI, Axis Bank, and others, have created a very competitive market for investment bankers in India. The above table gives an inkling of how much an investment banking professional earns in the top companies in the US. An average base salary https://1investing.in/ of an investment banking professional in the US ranges from USD 85K to USD 3000K+ based on their experience, job role, skills, etc. Mergers & Acquisitions hold a major scope among other services offered by investment banking firms. Types of mergers and acquisitions include – Mergers, Acquisitions, Tender Offers, Leverage Buyouts, Consolidations, etc.

When autocomplete results are available use up and down arrows to review and enter to select. An MD has the potential to earn a salary of lacs or more depending upon type of experience. Let’s look at some specific job titles and the salary that comes with them. An experienced Investment Banker with 5-10 years of experience earns around lacs, and 10 to 20 years of experience earns an around lacs. An fresher analyst in Investment Banking earns around Rs 6-8 lacs per annum on average in India. Access to AltUni Career Services like 1-on-1 live sessions for CV editing, mock interview, and career coaching.

Investment Banking Cover Letter

Also, the larger the size of the deal, the extra commission a bank could receive. Analysts often have less than two years of experience and are fresh grads. They frequently work on data collection, making presentations, and simple financial data analysis. Because the majority of financial concepts are developed at this period, having this experience is essential for anyone who wants to be a successful investment banker. The new jobs all involve taxing hours that leave very little time for a fulfilling personal life. While some make efforts to make their IB experience a stepping stone to a different career.

Most investment banks have a two-12 months program, after which the analyst rises to the affiliate rank. One of the benefits of working in a highly competitive industry is that you work with highly intelligent and well-connected individuals. You would find that both your clients and your colleagues are very skilled at what they do – whether it’s working on the latest technologies, government policies, or solving real world problems. You would also be part of challenging transactions and might get major responsibilities within a couple months of joining the investment bank. Scope of personal development is also enormous due to the continuous learning from your colleagues as well as the chance to learn everything from analytical thinking to communication to financial modelling.

That being said, Goldman Sachs paid its top 700 bankers over a million pounds in 2016. That being said, the reason why IB draws some of the best brains in finance is not just the huge compensation that grows wildly with hierarchy within the firms. Of course it is a major attraction, but there are other very important and yet more humble reasons as well. We present here a window into what entails to be a successful Investment Banker – education and skill requirements, best schools, compensations, job prospects, best firms, etc. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. If one isn’t adequately insured, it might lead to a financial ruin which can eat away all the hard earned money.