Contents:

The main difference between long run and short run costs is that there are no fixed factors in the long run; there are both fixed and variable factors in the short run . Long run costs have no fixed factors of production, while short run costs have fixed factors and variables that impact production. For both of these, fixed costs of building the necessary infrastructure are high. Natural monopolies tend to form in industries where there are high fixed costs.

Variable costs are costs that change in proportion to the level of business activity. For example, the cost of raw materials that a company buys to make its products is a variable cost. As the company produces more products, it will need to buy more raw materials, and so the cost of raw materials will increase. Fixed costs are incurred regardless of the production volume, whereas variable costs are directly related to the number of units a company produces. In economics, the most commonly spoken about fixed costs are those that have to do with capital.

Amyris Stock: Sub-Scale With High Fixed Costs And Limited Growth … – Seeking Alpha

Amyris Stock: Sub-Scale With High Fixed Costs And Limited Growth ….

Posted: Wed, 19 Apr 2023 13:33:20 GMT [source]

For those who aren’t natural number crunchers, bookkeeping can feel like a chore—particularly when it comes to dealing with money you owe other businesses. Multitasking is sometimes necessary in business, but it’s not efficient, and no one really does it well . Look over your and your employees’ workday to find any multitasking inherent in the schedule. See if you can separate tasks so that everyone is mostly doing one thing at a time. If you’ve been working with several suppliers, try offering to move all your business to just one of them in exchange for a deal. Also ask about discounts for high-volume purchases and see if you can change your purchasing schedule to take advantage of any discounts available.

Sometimes these costs are referred to as “step” costs because they jump up incrementally as production increases. Fixed costs remain the same in terms of their total dollar amount, regardless of the number of units sold. These are general expenditures that cannot be traced to any one item sold and may include electricity, insurance, depreciation, salary, and rent expenses. Using our example of $780 per unit in material and labor costs, this chart shows how variable costs increase in direct relation to the number of units manufactured.

What is the difference between fixed costs and variable costs?

Managers need to know how to control variable costs in order to maximize profits. They can be assigned easily and accurately to operating departments. Suppose Wasslak pays a fixed monthly rental fee of SAR 20,000 for the equipment it uses to make stickers. Even if the business does not make any stickers throughout the month, it must still pay SAR 20,000 to rent the equipment.

Fixed cost are considered an entry barrier for new entrepreneurs. In marketing, it is necessary to know how costs divide between variable and fixed costs. This distinction is crucial in forecasting the earnings generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns. In a survey of nearly 200 senior marketing managers, 60 percent responded that they found the “variable and fixed costs” metric very useful. These costs affect each other and are both extremely important to entrepreneurs.

Since they stay the same throughout the financial year, fixed costs are easier to budget. They are also less controllable than variable costs because they’re not related to operations or volume. Fixed costs are predetermined expenses that remain the same throughout a specific period. These overhead costs do not vary with output or how the business is performing. To determine your fixed costs, consider the expenses you would incur if you temporarily closed your business. You would still continue to pay for rent, insurance and other overhead expenses.

Types of Costs

Target your messages how to calculate stockholders equity on people’s purchase behavior, app activity, and more. Create a free website that comes with built-in marketing tools. Late fees and interest charges can quickly become expensive — and they’re avoidable if you keep an organized payment schedule and budget for them. After two months, there was a labor crisis in the city; the labor union went on strike against a new policy introduced by the government. As a result, fewer laborers were available—demand for labor rose—labor wages elevated overnight.

All of these costs will rise with an increase in business and contract when things are slower. You’re probably not selling all your goods or services at the same profit margin. Focus on those that have a high margin, and eliminate or reduce those that offer a small margin but require a larger investment or higher costs. Renegotiate your rent or find a more affordable office space.

Fixed and variable costs help businesses determine cost-based pricing, as the cost of producing a good is the summation of both. Cost-based pricing is the practice of sellers asking for a price that is derived from the cost of producing the item. This is common in competitive markets where sellers seek the lowest price to beat their rivals. Variable costs can be challenging to manage as they can vary from month to month, increase or decrease quickly, and have a more direct impact on profit than fixed costs. Variable costs are expenses that change directly and proportionally to the changes in business activity level or volume. It is important to note that fixed costs are not constant in the long run.

Variable Cost vs. Fixed Cost: What’s the Difference?

At that point, you’ll need to consider whether it would save you money to invest in the fixed expense of hiring staff to handle shipping in-house. It doesn’t hurt to ask for lower monthly payments on these agreements. Leasing companies and banks are often willing to extend your payments over a longer period of time to decrease the amount you must pay each month. While this might increase the interest rate, it can lower your costs until you’re in a more financially comfortable place.

While variable cost, on the other hand, is fixed at the per-unit level but increases linearly at a gross level with the increase in production. However, within a relevant range, say between 0 and 1,000 tables produced, fixed costs do not change. These include the ratio of fixed costs to total costs, the ratio of fixed costs to variable costs, and the Degree of Operating Leverage . Expenses that vary according to how much a business produces and sells are considered variable costs. Consequently, variable costs grow with rising production and diminish with falling production. Labor, utility prices, commissions, and raw materials are some of the most typical categories.

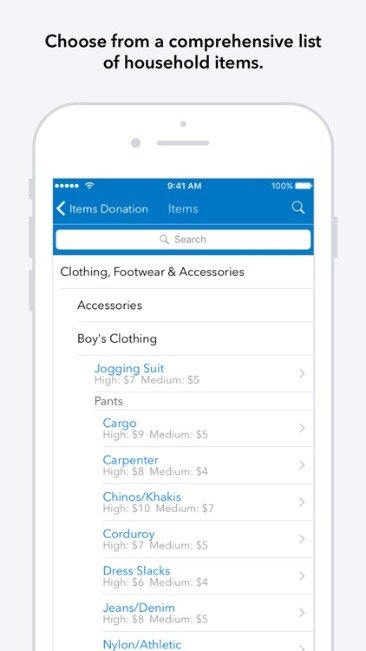

Accounts in Your Cart

Examples of fixed costs are rent, insurance, depreciation, salaries, and utilities. Examples of fixed costs are rent, tax, salary, depreciation, fees, duties, insurance, etc. Examples of variable costs are packing expenses, freight, material consumed, wages, etc. Fixed Costs remaining constant does not mean that they will not change in the future, but they tend to be fixed in the short run. Variable costs change directly with the output – when output is zero, the variable cost will be zero. The total variable cost to a business is calculated by multiplying the total quantity of output with the variable cost per unit of output.

The variable costs could change in the short term, of course. A labor shortage could mean that the bakery owner has to pay its bakers more per hour. Ingredient costs could change as well—an unfavorable year for wheat could raise the cost of flour. The owner should find, however, that their fixed costs remain relatively stable.

Business Studies

Talus Pay Advantage Our cash discount program passes the cost of acceptance, in most cases 3.99%, back to customers who choose to pay with a credit card. Partners Merchant accounts without all the smoke and mirrors. Earn your share while providing your clients with a solid service. Financial Institutions Integrate our services with yours to solidify your place as a trusted advisor for your commercial banking customers.

Understanding your organization’s cost structure is key to running a profitable business. Taking a deeper look at where you’re spending money will help you identify areas where you can cut costs, thereby increasing your profits. Variable costs for a restaurant owner include food, beverages, paper goods, wages for non-salaried employees, uniforms, and janitorial services.

Fixed costs are not permanently fixed; they will change over time, but are fixed, by contractual obligation, in relation to the quantity of production for the relevant period. In other words, there is a recurring cost, but the value of this cost is not permanently fixed. By definition, there are no fixed costs in the long run, because the long run is a sufficient period of time for all short-run fixed inputs to become variable. Investments in facilities, equipment, and the basic organization that cannot be significantly reduced in a short period of time are referred to as committed fixed costs. Discretionary fixed costs usually arise from annual decisions by management to spend on certain fixed cost items. Examples of discretionary costs are advertising, insurance premia, machine maintenance, and research & development expenditures.

Then they are recorded in inventory accounts, such as cost of goods sold. Fixed costs, on the other hand, are all coststhat are not inventoriable costs. All costs that do not fluctuate directly with production volume are fixed costs. Fixed costs include indirect costs and manufacturing overhead costs. In accounting, a distinction is often made between the variablevsfixed costs definition.

An understanding of the fixed and variable expenses can be used to identify economies of scale. This cost advantage is established in the fact that as output increases, fixed costs are spread over a larger number of output items. The term cost refers to any expense that a business incurs during the manufacturing or production process for its goods and services. Put simply, it is the value of money companies spend on purchasing and selling items. Businesses incur two main types of costs when they produce their goods—variable and fixed costs.

Cessna 172 Annual Maintenance and What It Will Cost You … – FLYING

Cessna 172 Annual Maintenance and What It Will Cost You ….

Posted: Thu, 20 Apr 2023 20:32:25 GMT [source]

The amount of product generated determines the fluctuation in variable costs. A fixed cost is a production cost that isn’t affected by the level of output. Fixed costs are the same whether a firm outputs 1 or 1,000 units. Variable costs increase when a firm goes from producing 1 to 1000 units.

- Companies use marginal analysis as to help them maximize their potential profits.

- In this case, the variable costs range from SAR 0 to SAR 4 million.

- As a small business owner, it is vital to track and understand how the various costs change with the changes in the volume and output levels.

- There is a linear relationship between variable expenses and production.

- They can be either fixed or variable, depending on how they change with output.

In fact, in most cases, fixed costs are required before production can even begin. In contrast, variable costs change directly with the amount of production. Variable costs go up as the number of units produce rises, and decreases if production lessens. It would not be the fixed costs related to the operationsthat cannot be altered and will not change with the level of production. Therefore, in most straightforward instances, fixed costsare not relevant for productiondecision, and incremental costs, or variable costs, are relevant for these decisions.

Because it increases progressively to make one additional product, a marginal cost is the same as an incremental cost. Variable costs are an element of the production process and an expense simultaneously. Lease and rent payments, property taxes, salaries, insurance, depreciation, and interest payments are typical of fixed costs. It’s also important to note that fixed costs are often called overhead costs. The idea of fixed and variable costs is therefore important to have for a better knowledge of production and profitability. Managers of companies know this and they keep track of both types of costs to manage a firm effectively.

Variable costs for a furniture maker could include raw materials, wages, packaging, and gas for delivery trucks. These costs will increase as production ramps up during certain times of the year. A restaurant owner will need a brick-and-mortar space in order to do business, so rent and insurance will be among their most notable fixed costs. Even if they opt for a delivery-only model, they still have to prepare food in a commercial kitchen that meets all health and safety standards.