Contents:

If payment is made to purchase the right or property that will be treated as capital expenditure instead of a Royalty. Treatment of royalty expense depends on the type of royalty paid and the terms, as well as the allocation method. If producing or manufacturing products where royalty expense is directly involved in production, such as the company’s sole right to market, sell or distribute a product, the royalty would be excluded from capitalizing under section 1.263A.

Researchers reveal U’s painful past with Minnesota’s Indigenous … – MPR News

Researchers reveal U’s painful past with Minnesota’s Indigenous ….

Posted: Tue, 11 Apr 2023 05:15:00 GMT [source]

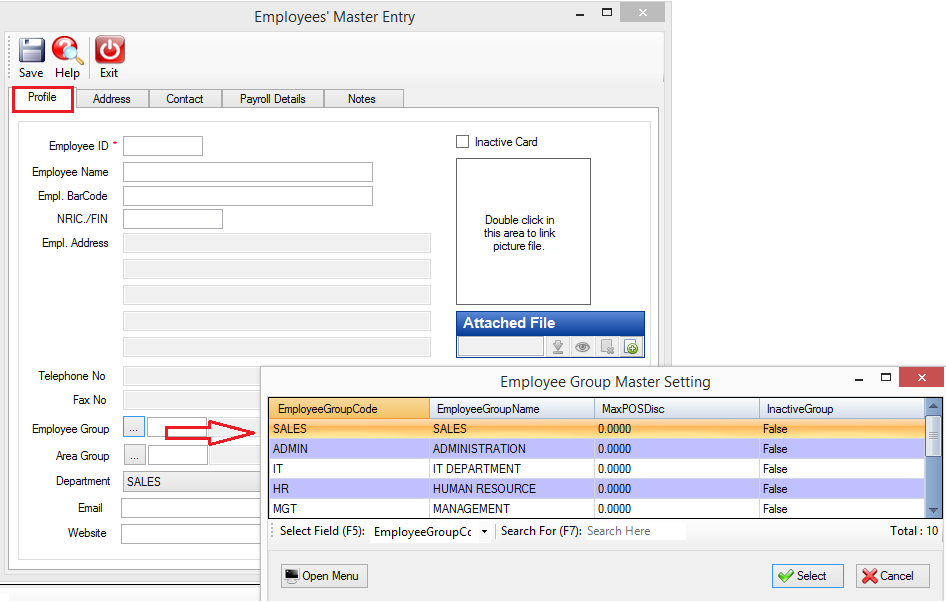

Don’t attempt to undertake this option unless you have a good technical person on staff in your company. Thus, in the subsequent years, the amount of Short Workings adjusts against the amount of royalty. This method of adjusting the capital for Short Workings is what we call Recoupment of Short Workings.

If the author receives an up-front payment, or advance, the publisher will deduct that from future royalty payments. Typically, the publisher takes on the responsibility of distributing and marketing the book, which allows the author to focus solely on writing. The agreement also might require the author to participate in some marketing activities, such as book signings, to increase sales. For example, an author might receive $1 per book for the first 10,000 sold, then $1.50 per book for any sales after that.

d Annual Licensing Summit in New York

If 20,000 books are sold within this period, then the author would receive a total of $25,000 in royalty payments (10,000 x $1 + 10,000 x $1.50). This would be recorded as a $25,000 debit to royalty expenses and a $25,000 credit to accrued royalties. Any accrued liability is reduced at the end of the period the royalties are paid out. If there is a provision in the income tax law that the payer of royalty should deduct tax at source at the prescribed rate and tax so deducted shall be deposited to the credit of the central government within a specified time. The landlord will get the amount of royalty or minimum rent after adjustment of tax.

(“DIY indies” are “do-it-yourself” independent songwriters – and, often, the performers as well – who record and publish under their own labels). Recording companies and the performing artists that create a “sound recording” of the music enjoy a separate set of copyrights and royalties from the sale of recordings and from their digital transmission . Oil and gas royalties are paid as a set percentage on all revenue, less any deductions that may be taken by the well operator as specifically noted in the lease agreement. If such an overpayment were to occur, it would be highly unlikely that the author would reimburse the publisher. Although each contract is different, a 20%-30% reserve held for three to four periods is not uncommon.

When Should Paid Royalties Be Reported As Expenses?

Sometimes, an arrangement involves milestone payments or a minimum guarantee. Milestone payments are forms of variable consideration that are paid if a target is reached. If milestone payments are based on sales or usage, the exception applies. However, a minimum guarantee, which is an amount a company must pay even if it doesn’t reach a certain level of sales or usage, would have to be accounted for separately because that portion is not a sales- or usage-based royalty. In the staff’s view, View A is the appropriate application of the new revenue standard. A guaranteed amount is not variable consideration; therefore, it is not subject to the royalties recognition constraint.

A licensing agreement is a contract that allows one party to use and/or earn revenue from the property of the owner . An inventor or original owner may choose to sell their product to a third party in exchange for royalties from the future revenues the product may generate. For example, computer manufacturers pay Microsoft Corporation royalties for the right to use its Windows operating system in the computers they manufacture. Royalty payments typically constitute a percentage of the gross or net revenues obtained from the use of property.

Book

Bengal Coal Ltd. got the lease of a colliery on the basis of 50 paise per ton of coal raised subject to a Minimum Rent of Rs. 20,000 p.a. The tenant has the right to recoup short-workings during first four years of the lease and not afterwards. You are required to give the Journal entries and ledger accounts in the books of the company. It has already been stated above that recoupable short-working appears in the assets side of the Balance Sheet as a current asset on the assumption that the same will be recouped in future. Sometimes, it may not be possible for the lessee to recoup the amount of short-working due to many factors although he has got the legal right to recoup.

- Investopedia requires writers to use primary sources to support their work.

- The material and information contained herein is for general information purposes only.

- Where a performance has co-writers along with the composer/songwriter – as in a musical play – they will share the royalty.

- This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia.

- Audit your own system to be sure it is accounting for royalty expenses accurately.

By preventing revenue recognition on sales- or usage-based royalties until the later of these two criteria have been met, the FASB has removed the uncertainty in estimating these royalties. Ultimately, these criteria were designed to protect the relevance and quality of financial statements information. A license of intellectual property must be the sole or predominant item to which a royalty relates. A royalty that serves as consideration for any other type of licensing arrangement does not qualify for the exception. When buying or using royalty-covered items, make sure the royalty percentage is recorded in a double-entry accounting system.

TechCo expects bookkeeper definition royalties to significantly exceed the $1 million minimum each year. A fixed fee in exchange for a license that is a right to use intellectual property is recognized at the point in time control of the license transfers. Royalties in excess of the minimum would be recognized in the period the sales occur. Some royalty arrangements have variable payments that guarantee the licensor some profit. The licensee agrees to pay the greater of a royalty payment or a fixed sum, known as minimum rent.

Streaming as an alternative financing source has several advantages when viewed from a mining company’s perspective. As a result, many candidates exist for which streaming-and-royalty deals present a potentially attractive form of financing, such as when a company is in need of capital to fund growth projects, engage in M&A, or further pay down debt. These deals are especially attractive for mining companies for which the streamed product is noncore or a by-product.

Every https://1investing.in/ action in your business is added to your ledger and results in simultaneous changes to at least two accounts, but it’s not always clear whether these are increasing or decreasing an account’s value. The developer in effect receives upfront payment of future royalties. In cases where the lessee fails to recover the Short Workings within the stipulated time, the Short Workings lapse and is debited to the P&L Account for the period in which the recoupment lapses.

For instance, as per fixed right, say the lessee can recover Short Workings within 2 years from the date of lease. Patent Royalty is paid by the user to the owner based on the number of items produced. The contract will detail the scope and limits of the use of the property. For example, you might allow someone just one-time use, or you might allow perpetual use of your images. Royalties for oil, gas, and mineral properties; these may be based on either revenue or on units, such as barrels of oil or tons of coal. Example 2 – A math teacher who once published a book of poetry will report royalties on Schedule E. If he had published a math tutorial then royalties would be self-employment income.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

- The developer has earned 4,000 and makes the entry to transfer this amount from unearned royalties in the balance sheet to the royalty revenue account in the income statement.

- As growth in sales increases, the royalty percentage could increase to the maximum.

- The actual discount factor used depends on the risk assumed by the principal gainer in the transaction.

- The payments might be for a share of proceeds from the sale of a writer’s or composer’s work, for example, or a share of payments that goes to inventors or service providers for the right to sell their invention or service.

Assuming net income remained the same for the next period, a different set of entries would be made. First, the royalty expense account would be debited for the full royalty amount, $7,000. The prepaid royalty account now only totals $3,000 ($10,000 original minus $7,000 from last period).

Where Royalties are less than minimum rent and shortworkings are recoverable in next years. Sometime, there may be stoppage of work due to conditions beyond control like strike, flood, etc. in this case, minimum rent is required to be revised as provided in the agreement. An Author or publisher; lessee or patentor who takes out rights from the owner on lease against the consideration is called tenet.. Allow a lot of time to enter data on contracts, royalty recipients, sales history, etc., prior to going live. Many university presses are familiar with the Cat’s Pajamas system , which has a royalty system integrated into its order-processing software.